Expert help for Fifers on dealing with post-Christmas debt

and live on Freeview channel 276

But, for some, the festive period may have brought additional stress if they are already struggling with debt and money problems, particularly as a result of the pandemic.

Many may have lost jobs or have had to use savings just to get by this year and might be worrying about building up a lot of debt over the past few months.

Advertisement

Hide AdAdvertisement

Hide AdHowever, there are local organisations on hand to help anyone who might be worrying about their finances and how they are going to manage their bills after the festive season.

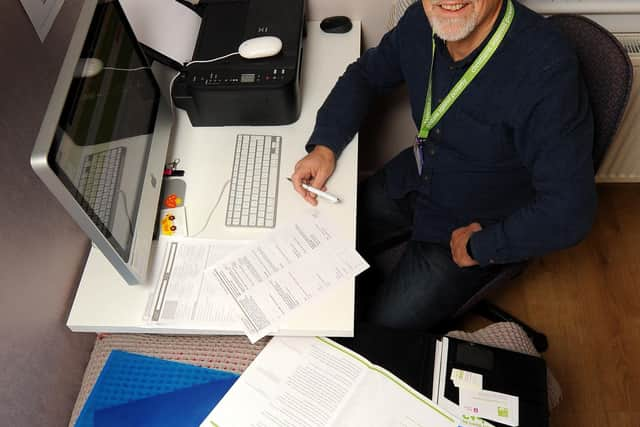

Christians Against Poverty (CAP) is one of a number of free debt counselling services available and the charity has a debt centre covering Burntisland and Kirkcaldy, which is supported by Burntisland Parish Church.

Doug Drysdale, CAP debt centre manager for Burntisland and Kirkcaldy, said the service can help anyone who feels weighed down by debt.

He said: “CAP is one of a number of free debt counselling services available in Scotland. You may think your situation is impossible, but there is hope. While Covid-19 in 2020 has made it a tough year for everyone and for services, we have adapted our appointments in line with Government guidelines. Our friendly team will give you a listening ear and provide a real solution to your debts.

Advertisement

Hide AdAdvertisement

Hide Ad"They will help you gather any paperwork you need to do with your debts and send it off to our head office, where they’ll work out a budget and the best route out of debt for you, to see you through to financial freedom and beyond. Our service is free, calls to our head office are free and we’ll provide pre-paid envelopes so you can send paperwork to us.”

He said no-one could have predicted the impact Covid-19 would have this year: “Circumstances can change very quickly and the reality is that things don’t always go as planned.

"We’re seeing that this year with increased unemployment, reduced income due to the furlough scheme, lack of work for many working on zero-hour contracts, increased use of foodbanks etc.

Fife Council reveals how often officers have spied on individualsCosta Coffee bids to overturn ruling on opening hours of new Fife...

Advertisement

Hide AdAdvertisement

Hide Ad"This time last year no one could have predicted the devastating impact that Covid-19 has had on our lives, our loved ones and our finances in 2020 and Christmas can be a time when we become more aware of our financial difficulties.”

He estimates that problem debt will more than triple in 2020 and advises people not to ignore it but to seek help straight away.

Doug said CAP can offer a range of solutions including repayment plans, debt arrangements schemes and insolvency options.

He continued: “We work out a realistic budget that priorities your essential bills, we will negotiate affordable payments with each creditor and attempt to stop unfair interest and charges where possible.

Advertisement

Hide AdAdvertisement

Hide Ad"In most cases a CAP Plan is set up with you, you will make one monthly payment into your CAP Plan to cover your bills and debts and CAP will then distribute this on your behalf.

"You can use your CAP Plan to pay your bills and debt repayments until you are debt free.”

He added: “We are there to help and support. We understand that people can feel embarrassed or ashamed and it is a big step to ask for help but we are passionate about helping people find a real way out of debt.”

To book an appointment, people can call the new enquiries team free on 0800 328 0006.

Advertisement

Hide AdAdvertisement

Hide AdMeanwhile, another organisation which can also offer support is Citizens and Rights Advice Fife.

CARF offers free, independent impartial and confidential information and advice on a wide range of subjects, including debt and money advice.

Scott Crooks, money advice co-ordinator, said this year has been difficult for many people due to the pandemic: “Following government intervention with forbearance on debt recovery, there has been an understandable shift in our client’s priorities with this being directed to those seeking assistance with benefit, furlough and employment matters.

"As a result of forbearance on debt recovery, we are aware that those in financial difficulty may delay seeking assistance.

Advertisement

Hide AdAdvertisement

Hide Ad"As forbearance draws to an end, and the hold on creditors taking action in respect of consumer debts such as credit card, loans and mortgages along with those with rent arrears are lifted, we expect a significant rise in those seeking advice on how to deal with their debts.

"We currently anticipate this taking place in the first quarter of 2021 – current estimates suggest a 60 per cent increase in debt assistance across the UK being required.”

He continued: “Our money advisers can assist with all sorts of financial issues, from simple budgeting problems to repossession. They also take a holistic approach by reviewing debts but also maximising income to make sure their clients are getting all the money they are entitled to as well as reviewing expenditure such as fuel / energy bills and insurance encouraging price comparisons in order to get the best deal. Our advisers can assist with applications for bankruptcy and applications to the Debt Arrangement Scheme,

“The money advisers won’t tell you what to do, but they will explain your options and the possible outcomes - they want to empower you to take control of your situation.”

Advertisement

Hide AdAdvertisement

Hide AdHe added: “Early intervention is always the best course of action where possible. Seeking advice early will maximise the solutions available for dealing with your debts whilst minimising interest and charges applied by creditors. Speaking with a money adviser will help ease your worries and you will feel better for doing so.”

Anyone looking for money advice can contact the CARF Money Advice Unit on 0345 1400 094 or webchat (via the website www.cabfife.org.uk ), from 8.30am to 4pm, Monday to Friday.